Discover the best insurance app development company. Learn essential factors and benefits to create a standout mobile insurance app.

Many people don’t bother buying insurance until something bad happens and hefty bills emerge. Fortunately, this way of thinking is shifting due to the increasing use of insurance applications.

Creating a mobile insurance app is a great way to stand out in this business sector. Let’s examine the process of insurance application development, from comprehending the basic feature set to identifying the ideal contractor.

Who is the target audience for insurance apps?

Developing insurance apps starts with understanding the target audience, which mainly includes customers and agents.

Customers

- Individual users. They seek a convenient way to manage their insurance policies, file claims, and receive updates.

- Families. Often, one person manages insurance policies for the entire family. The app should allow easy tracking of all policies.

- Businesses. SMBs need to manage corporate insurance policies and requests.

If your target user is a customer, your insurance app UX design should be intuitive and user-friendly. Policy management, claim filing, and notifications are the must-have functions of these insurance apps.

Agents

- Insurance agents. They use apps to manage their clients, track claims, and receive important updates.

- Brokers. They need apps for market analysis, managing multiple insurance companies, and maintaining client communications.

For agents, the key requirements are robust client management tools, detailed analytics, and integrating insurance apps with other systems. As a rule, these apps are more complex.

Essential features integrated into insurance apps

Every insurance app must have fundamental features to ensure its usefulness and ease of use for both customers and agents.

|

What should be insured? |

Key features |

| Auto | – Policy tracking

– Filing accident claims – Premium and coverage calculations – Renewal reminders |

| Health | – Policy management

– Doctor appointment scheduling – Claim submission for medical expenses – Health tracking features |

| Life | – Policy overview

– Beneficiary management – Premium payment management – Claim filing for beneficiaries |

| Home | – Property management

– Claim filing for damages – Premium calculations based on property value – Policy renewal reminders |

| Business | – Corporate policy management

– Employee benefit tracking – Claims management for business-related incidents – Risk assessment tools |

What does mobile app development for the insurance sector involve?

Requirement gathering

This stage is dedicated to understanding client needs, the target audience, and regulatory requirements.

Insurance app UX design

- Wireframing. Creating a blueprint of the app’s layout.

- Prototyping. Developing interactive prototypes to visualize user interaction.

- User testing. Gathering feedback from potential users to refine the design.

Backend development

- Database design. Structuring databases to handle user data securely.

- API development. Creating APIs to connect the app with backend systems and third-party services.

Frontend development

- User interface (UI). Developing the app’s visual elements.

- Functionality implementation. Coding features are based on the initial requirements.

Testing

- Unit testing. Ensuring individual components function correctly.

- Integration testing. Verifying that different modules work together seamlessly.

- User acceptance testing (UAT). Making sure end users are satisfied with the application.

Deployment

Releasing the app to the general public.

Post-launch app support

- Maintenance. Regular updates are needed to fix bugs and improve performance.

- Customer support. Providing help desk services to resolve user issues.

- Feature updates. Adding new features based on user feedback and market trends.

How can I choose the right contractor to develop an assurance app?

Choosing the app development company for an insurance app can make or break your project. Here are the factors you should consider to cherry-pick the right contractor:

Experience. Hunt for contractors with a robust portfolio showcasing their expertise in insurance apps or similarly intricate projects. Verify their knowledge of the insurance sector and their track record of successful projects.

Communication. When providing updates, the contractor must be prompt, open, and proactive. Effective communication ensures that problems are resolved quickly and the project stays on schedule.

Prices. Compare the pricing of different insurance app development services, but keep in mind that the greatest solution isn’t necessarily the cheapest. Some companies may dump the prices to attract more clients, but their background can be too humble for your project.

Timeframes. Set and agree on realistic timeframes for each project phase and final delivery. Make sure the contractor can deliver on their commitments with prior performance and has a well-thought-out plan to meet deadlines.

Examples of popular insurance apps to inspire

Looking at successful insurance apps can provide valuable insights and inspiration for your project. Here are a few notable examples.

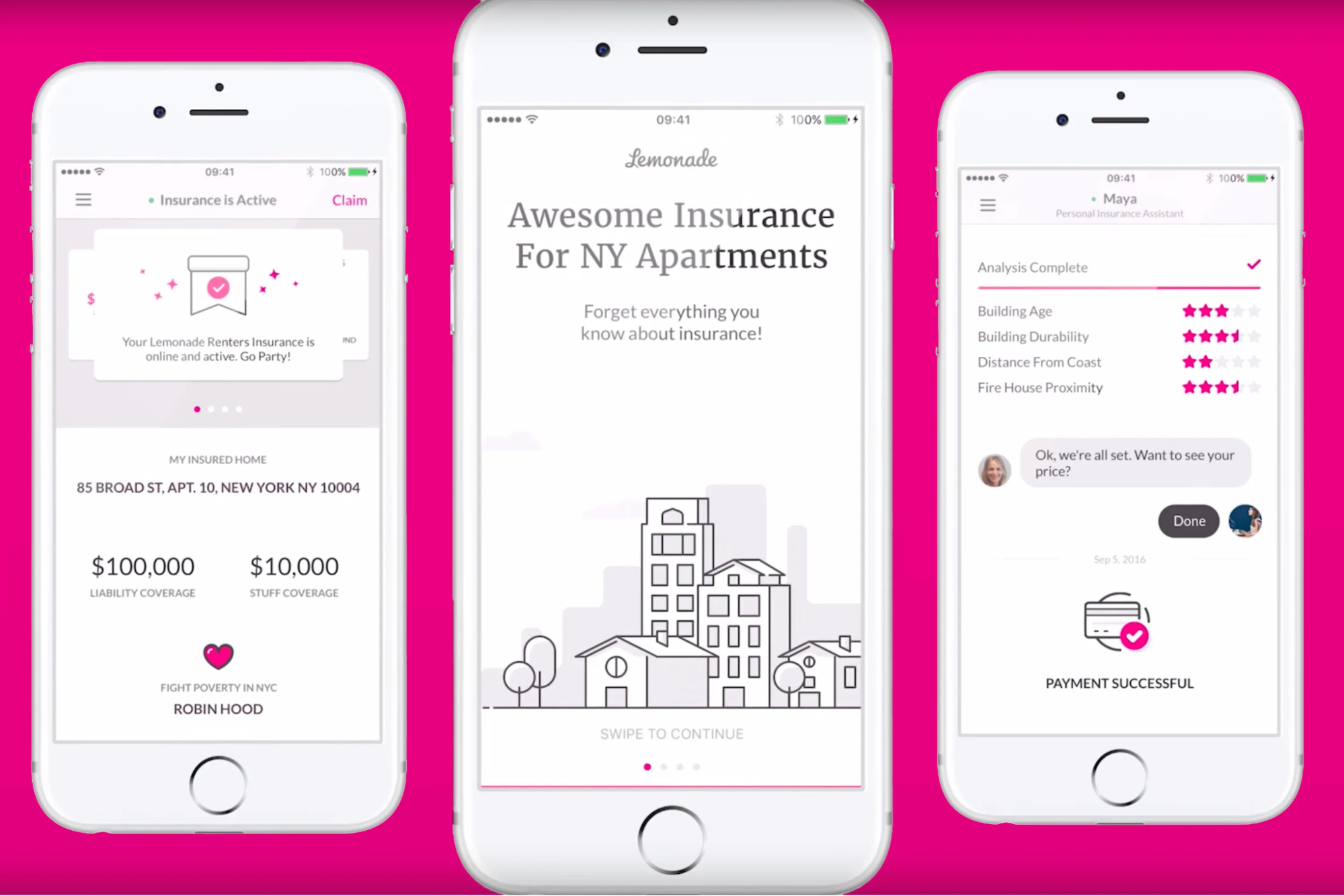

Lemonade

source: emsekflol.com

Lemonade is a famous platform in the insurance sector. Its target users are homeowners, renters, and pet owners.

What are the important aspects of this app? Lemonade uses AI chatbots to streamline the insurance purchasing and claim filing processes. The software stands out due to its quick 90-second insurance application process.

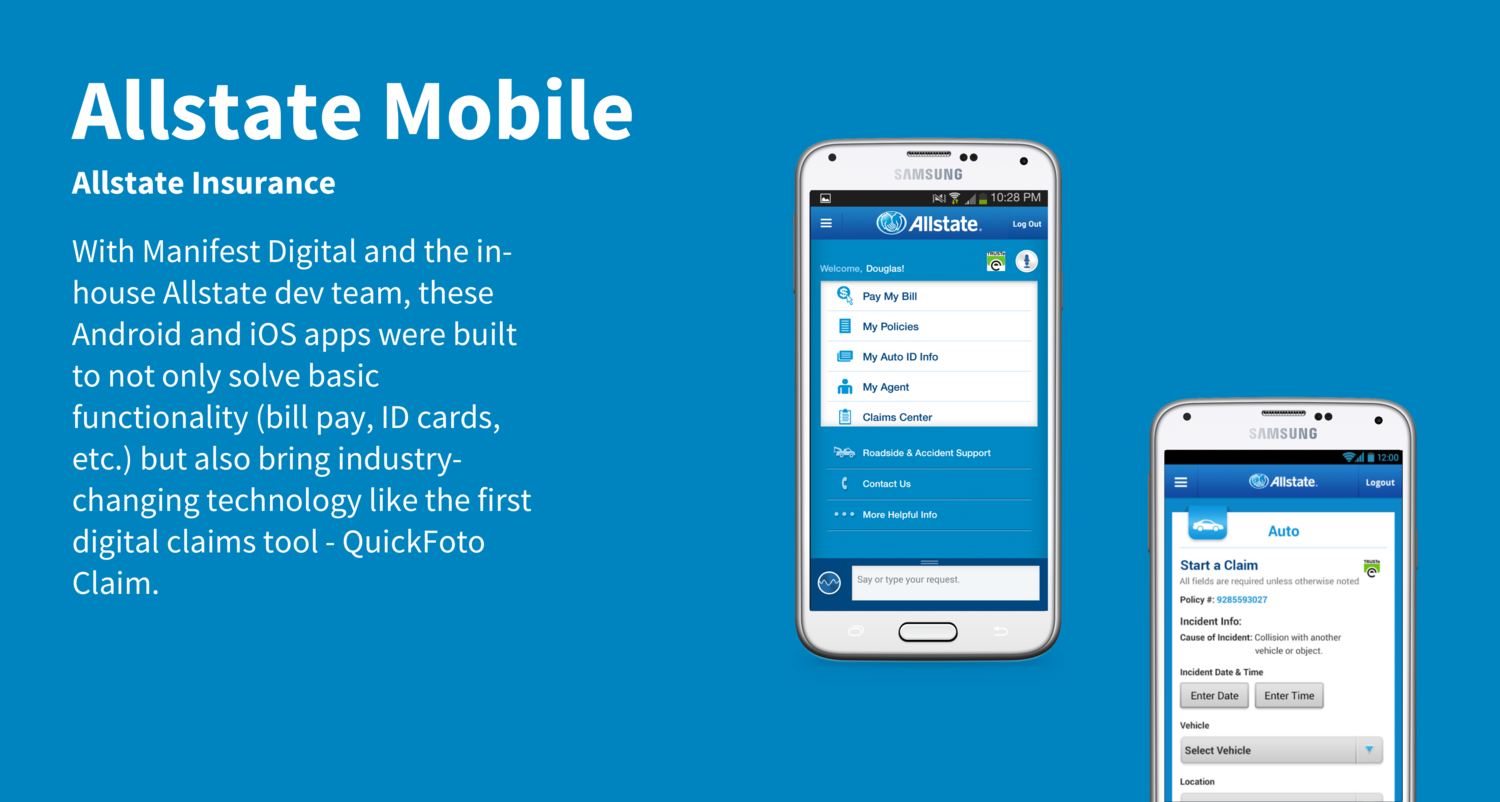

Allstate Mobile

source: dannyzagorski.com

Allstate Mobile offers full-fledged insurance services. It provides features like digital ID cards, claim tracking, and roadside assistance.

What is significant about this app? The integration of various insurance types into a single app, combined with features like Drivewise, which tracks driving behavior to offer personalized discounts, highlights Allstate Mobile’s commitment to user-centric innovation.

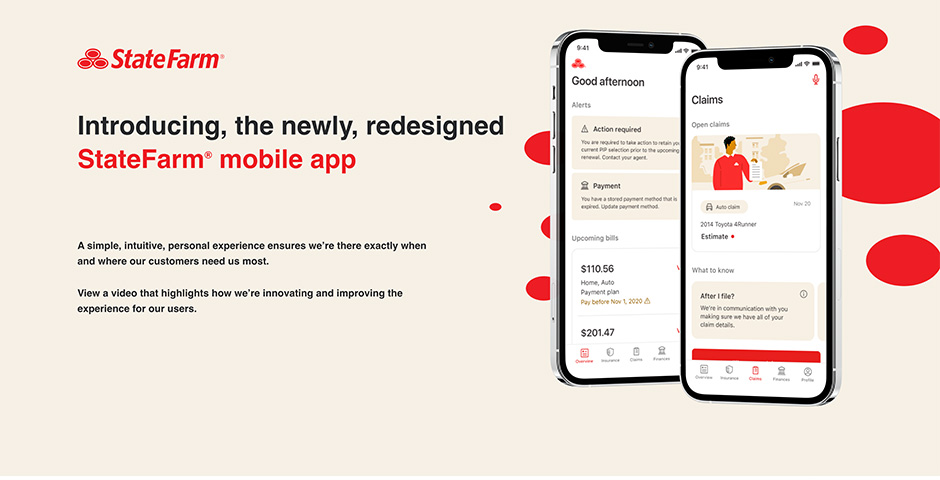

State Farm

source: webbyawards.com

Numerous services, such as health, life, home, and vehicle insurance, are available on the State Farm app. Users may digitally access their insurance cards, manage their plans, and process claims with them.

What makes this software noteworthy? The State Farm app is renowned for its extensive coverage options and flawless user interface, which combines investing and banking services to give consumers a full tool for managing their finances.

Wrapping up

Successful insurance apps combine user-centric design, innovative technology, and comprehensive functionality to meet customer needs effectively.

The success of your project will depend either on your involvement in the insurance app building or on the development company. Do your research and choose the contractor thoroughly. Consult with the right development company to implement the best practices for insurance sector app development. Good luck!

Was this news helpful?

Yes, great stuff!

Yes, great stuff! I’m not sure

I’m not sure No, doesn’t relate

No, doesn’t relate