From understanding the importance of coverage to tailoring insurance options to your needs, discover why comprehensive insurance solutions are essential for protecting your business.

Ensuring the protection of your business is paramount in today’s unpredictable world. One crucial aspect of safeguarding your enterprise is securing comprehensive insurance coverage. From unexpected accidents to legal disputes, having the right insurance solutions in place can provide you with peace of mind and financial security.

Understanding the Importance of Comprehensive Insurance

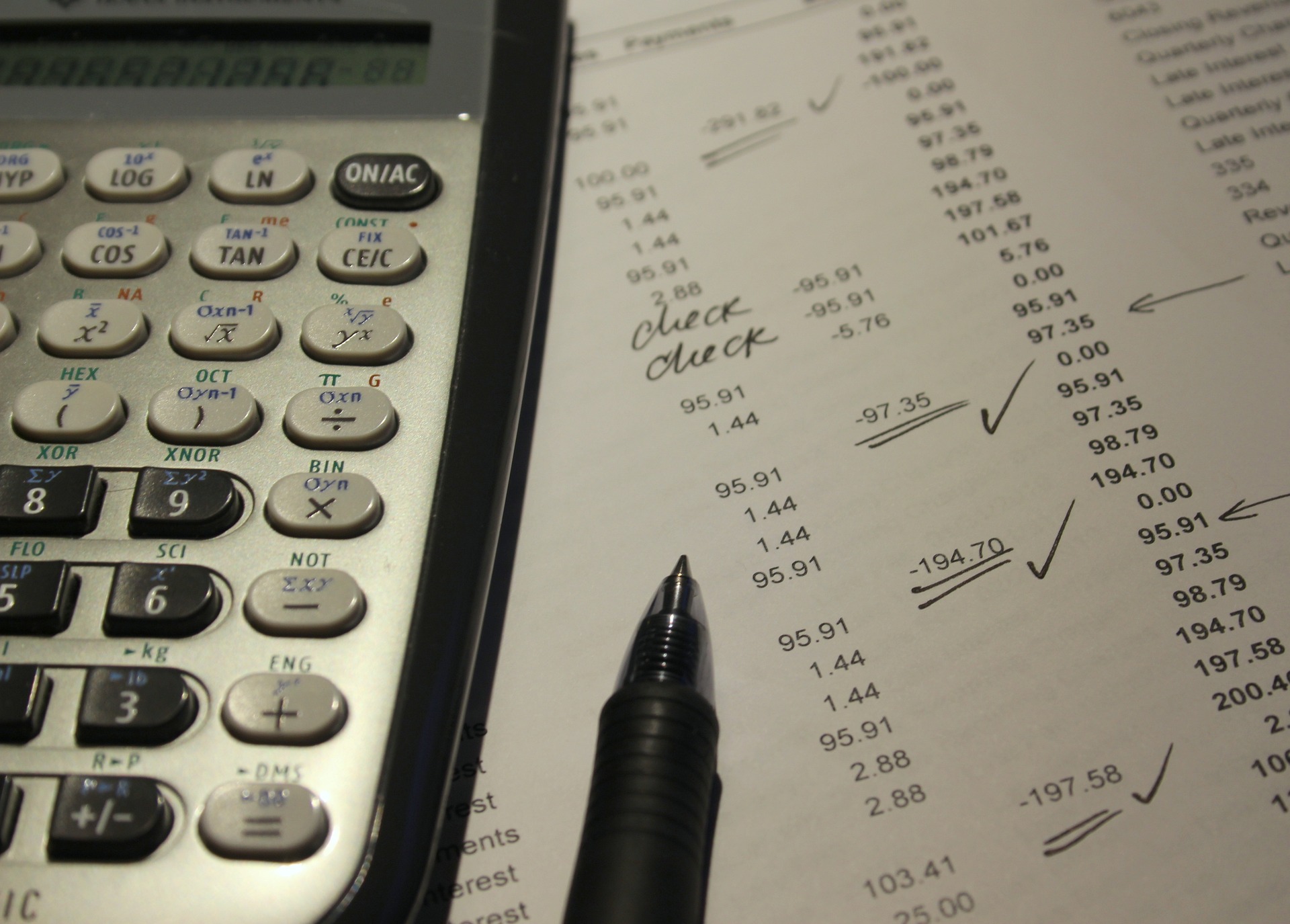

When running a business, you face various risks daily. These risks can range from property damage due to natural disasters or theft to lawsuits filed by dissatisfied customers or employees. Without adequate public liability cover, your business could suffer significant financial losses that may even lead to its downfall. Comprehensive insurance acts as a safety net, offering protection against unforeseen events that could threaten your company’s viability.

Types of Comprehensive Insurance Coverage

There are several types of insurance coverage designed to address different aspects of your business’s needs. General liability insurance protects you against claims of bodily injury or property damage caused by your business operations. Property insurance covers damage to your physical assets, such as buildings, equipment, and inventory, due to events like fire, vandalism, or extreme weather.

- General Liability Insurance: This type of insurance provides coverage for third-party claims of bodily injury, property damage, and advertising injury caused by your business operations or products. For example, if a customer slips and falls on your premises or alleges that your advertising misled them, general liability insurance can cover the associated medical expenses, legal fees, and settlements.

- Property Insurance: Property insurance protects your business’s physical assets, including buildings, equipment, inventory, and furniture, against various perils such as fire, theft, vandalism, and natural disasters. This coverage not only helps repair or replace damaged property but also reimburses you for any income lost due to business interruption caused by covered events.

- Professional Liability Insurance (Errors and Omissions): Professional liability insurance, commonly known as errors and omissions (E&O) insurance, is essential for businesses that provide professional services or advice. It protects against claims of negligence, errors, or omissions that result in financial loss or harm to clients.

- Commercial Auto Insurance: If your business owns or uses vehicles for work purposes, commercial auto insurance is necessary to protect against accidents, property damage, and liability claims. This coverage extends to company-owned vehicles as well as vehicles leased, hired, or borrowed by your business.

Tailoring Insurance Solutions to Your Business Needs

No two businesses are alike, which is why it’s crucial to tailor your insurance coverage to suit your specific needs and risks. Conducting a thorough risk assessment can help you identify potential threats and determine the appropriate insurance policies to mitigate them. Work closely with an experienced insurance agent or broker who can provide personalized guidance and help you navigate the complexities of selecting the right coverage for your business.

The Cost of Being Uninsured

While investing in comprehensive insurance may require an upfront financial commitment, the cost of being uninsured far outweighs the expense of premiums. Without adequate coverage, your business could be vulnerable to substantial financial losses that may be difficult to recover from. In the event of a lawsuit or unforeseen disaster, having insurance can mean the difference between staying afloat and facing bankruptcy. By prioritizing insurance protection, you’re safeguarding your business’s future and ensuring its long-term sustainability.

In an ever-changing business landscape, protecting your assets and operations is non-negotiable. Comprehensive insurance solutions offer a safety net against the myriad risks that businesses face daily. From general liability and property insurance to professional liability coverage, there are various options available to tailor insurance protection to your specific needs.

Was this news helpful?

Yes, great stuff!

Yes, great stuff! I’m not sure

I’m not sure No, doesn’t relate

No, doesn’t relate